Thames Water faces independent supervision after credit downgrades lead to licence breach

2024-08-07

2024-08-07

https://www.thisismoney.co.uk/money/markets/article-13717431/Thames-Water-faces-independent-supervision-credit-downgrades-lead-licence-breach.html

HaiPress

https://www.thisismoney.co.uk/money/markets/article-13717431/Thames-Water-faces-independent-supervision-credit-downgrades-lead-licence-breach.html

HaiPress

Ofwat is set to impose an independent monitor on Thames Water after the debt riddled utility firm was stripped of two investment-grade credit ratings.

The monitor will supervise Thames Water and report back findings to Ofwat,ensuring the group improves its performance via series of commitments,the regulator said.

Credit firm Moody's downgraded Thames Water's highest-ranked bonds to junk on 24 July,citing the water company's 'weakening liquidity position'.

A week later,Standard & Poor's reduced the group's Class A debt rating to BB and its Class B debt rating to B,saying its liquidity had 'deteriorated to a less-than-adequate position.'

The downgrades meant Britain's biggest water supplier had officially breached its operating licence.

Regulatory warning: Ofwat has said an independent monitor could be appointed to supervise Thames Water after the firm lost its two investment-grade credit ratings

The regulator now wants the company,which serves about 16 million customers across London and the Thames Valley,to hire an independent monitor to oversee progress against its transformation plan.

Ofwat also said Thames Water should choose new non-executive directors,conduct an equity raise,and formulate a 'suitable operational' business plan to help turn around its fortunes.

These four commitments are subject to consultation and will persist until Thames Water gains back its two investment-grade credit ratings,Ofwat added.

RELATED ARTICLES

Previous 1 Next

Three water firms face £168m fine for excessive sewage...

Moody's downgrades Thames Water bonds to 'junk' in fresh...

Ofwat launches sewage probes into four more water companies

Water shares soar as watchdog lines up record £88bn funding...

Share this article

ShareDavid Black,chief executive of Ofwat,said: 'We are clear that Thames Water needs to remedy its licence breach,turn around its operational performance and secure backing from investors to restore its loss of investment grade credit rating.

'These enforceable commitments will include our putting an independent monitor into the business,to report back to us on what is happening to drive meaningful change in performance,and to ensure appropriate expertise is added to their Board.

'We will continue to monitor progress very closely and will not hesitate to take any further action if necessary.'

Read More

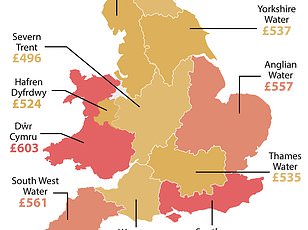

How much YOUR water bill will rise - and what you can do NOW to help prevent higher costs

Ofwat's latest action against Thames Water comes a day after it proposed fining the company £104million for excessive sewage discharges.

Thames Water,along with Northumbrian Water and Yorkshire Water,were discovered to have regularly released sewage into rivers and seas rather than in 'exceptional circumstances' as the law permits.

Britain's water industry has faced backlash from environmental groups,politicians and consumers in recent years due to its poor record on sewage discharges.

According to the Environment Agency,water companies were responsible for 3.6 million hours of sewage spills across England in 2022,over double the 1.75 million hours recorded the previous year.

Trade association Water UK called the increase 'unacceptable' but blamed it on higher rainfall,a major driver of storm overflows.

However,the Environment Agency said this 'does not affect water companies' responsibility to manage storm overflows in line with legal requirements.

To help clean up the UK's rivers and waterways,Ofwat ruled in July that English and Welsh water firms could spend £88billion between 2025 and 2030 on infrastructure upgrades.

It plans to fund these improvements through raising household water bills by £94 on average over the five-year period,excluding inflation.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Learn More

Learn More

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

Learn More

Learn More

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Learn More

Learn More

Saxo

Saxo

Get £200 back in trading fees

Learn More

Learn More

![]()

Trading 212

![]()

Trading 212

Free dealing and no account fee

Learn More

Learn More

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team,as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you